Teaching kids about the value of a dollar is slightly different these days. Lessons on how to balance an actual checkbook or make change with coins are far less common. However, the core concepts are the same. Kids are more likely to see transactions happen with credit cards and smartphones everywhere from the computer to the coffee shop. So how can you teach kids about how to be responsible with money while also making it fun? There are the classic board games that we all know and love, and then there are some newer ones, including online games and apps, that are wonderful for teaching your kids about all the facets of financial literacy. We’ve rounded up 16 of the best money games for kids so you can start to teach them the basics (and more!) today.

Download The Krazy Coupon Lady app for more actitivities and game ideas for kids.

1. Monopoly – Starting at $13.99

One of the most popular board games ever sold, Monopoly has players buy and trade properties, collect rent, and move around the board until one person drives the rest into bankruptcy. It not only teaches key terms such as bankruptcy, mortgage, investment, and debt, but it helps to teach kids basic budgeting and introduces the importance of maintaining an emergency fund. There are many different versions depending on what your child’s interests are, including Marvel, Roblox, “Unicorns vs. Llamas,” and a “Sparkle Edition” complete with pearlescent dice. Check out Monopoly Jr. for kids 5 years old and up.

2. Pay Day – $17.99

Pay Day is another classic board game that teaches kids ages 8 and up the basics of balancing cash flow. The object of this game, which has been around for almost 50 years, is to be the player with the most money left. Concepts taught in this quick-playing game include budgeting, expenses, income, bills, and loans.

3. The Game of Life – $14.53

The Hasbro classic The Game of Life has many different versions, from Pirates of the Caribbean to Super Mario to a super fun Giant Edition. The game not only teaches kids how to navigate life’s ups and downs in a fun way, but it educates them on important life events that can impact finances such as college, career choices, marriage, being sued, and owning a home, leading to eventual retirement at the end of the game.

4. U.S. Mint Coin Classroom – Free (online)

For kids in preschool or elementary school, the U.S. Mint Coin Classroom is a free website run by the U.S. Department of the Treasury and teaches kids the basics of money, including identifying, counting, designing, and making coins. Games on their site cover addition, subtraction, multiplication, and division. Information on coin history and collection is also covered. Their website is easy to navigate for younger children and has full narration for little ones who need assistance with reading.

5. Buy It Right – $29.99

Fans of Buy It Right say that the money looks realistic and the gameplay is super simple, letting kids handle the paper and plastic money in real-life shopping situations (including taking money out of an ATM). Kids can choose to play with or without the included calculator, depending on whether or not they need the extra math practice, and the game has a few different levels of difficulty so it can be adjusted for younger or older kids. Concepts for this game include buying and selling, discounts and sale pricing, using coupons, and making change.

Related: Summer Reading Programs for Kids

6. ACT Your Wage – $29.99

This board game from Dave Ramsey, best-selling author, personal finance expert, and radio show host, is aimed at older elementary children (ages 10 and up) and gets into slightly more complicated concepts and teaches the importance of paying off debt. The object of ACT Your Wage is to keep your savings up and expenses down by paying your bills using the envelope system and trying to keep an emergency fund above $1,000. The object is to be the first around the board to end up debt-free.

7. The Stock Exchange Game – $49.99

For kids who are curious about stocks, bonds, and everything in between, pick up The Stock Exchange Game. A fun way to learn about finance and money management for kids, there’s no knowledge needed about economics or stocks to play, and there are three levels of gameplay: family-friendly, strategy level, or teams play. The object of the game is to retire successfully; each trip around the game board represents a year of life. Vocabulary learned in this game includes stock mergers, acquisitions, hostile takeovers, private vs. public companies, stock options, assets, and returns. Reviews say that gameplay is easy but YouTube tutorials make learning the game foolproof.

8. Financial Football – Free (online/app)

Sponsored by Visa, this NFL game for older kids covers various topics aiming to help to build a strong financial future for everyone who plays. The game combines classic football plays and graphics (reminiscent of football video games such as Madden NFL) with financial trivia that the player must answer to advance. Taxes, credit scores, and even foreign exchange markets are concepts covered in the game. The three different levels correspond to your child’s age (Rookie, 11+; Pro, 14+; Hall of Famer, 18+). Facts flash across the screen when levels are loading too, so there is no time wasted when it comes to learning about being financially responsible. Financial Football can be played on the computer, but there is also an app for the game, available for both Apple and Android users. For soccer fans, there’s also a similar version of the game available, Financial Soccer.

9. Cash Puzzler – Free (online)

For younger kids (ages 3 and up), Visa created a money identification game, Cash Puzzler. This game combines fun facts about U.S. presidents with memory and puzzles, enabling kids to piece together a virtual puzzle of U.S. currency. Choose between 1-, 5-, 10-, 20-, 50-, and 100-dollar bill puzzles.

10. Peter Pig’s Money Counter – Free (online/app)

Counting, sorting, and identifying money are all covered in this iOS and Android app, which can also be played online. Kids will learn the value of a dollar while also learning fun facts about U.S. currency. After completing the game, players ages 5 and up are rewarded with a trip to the virtual store to buy accessories within their budget to dress up Peter Pig in fun scenes.

11. The Payoff – Free (online)

This online game teaches teens the basics of being financially responsible. The game is played in a web app that simulates a cell phone where characters can text, chat, check emails, and check bank balances, all within the game. Scores go up when players save money or make good financial decisions and go down when they spend or make poor decisions. Core concepts of this game include transferring money to different accounts, insurance, online safety, and preparing for unexpected financial emergencies.

12. Con ‘Em If You Can – Free (online/app)

Learning to be responsible with money is an important lesson for kids, and a piece of that responsibility is learning about scams and other cons when it comes to their financial health. Enter Con ‘Em If You Can, an online game developed by the Investor Education Foundation which teaches kids firsthand about the types of persuasion tactics used to get away with financial fraud. Players use these tactics and accumulate wealth as they move through the fictional town of Shady Acres, all while avoiding Fiona, the Fraud Fighting Agency’s lead agent. This game can be played on the computer or downloaded from the Apple or Google Play store.

13. Cashflow – $60

Developed by renowned entrepreneur and motivational speaker Robert Kiyosaki, Cashflow teaches kids ages 6 – 10 investing and wealth building without taking actual risk. Kids will develop good behavior and habits around money through playing the game, which will in turn help them not just to survive and escape the rat race but actually live a meaningful life. The game teaches kids how to “make your money work for you,” which is Kiyosaki’s foundation.

14. The Entrepreneur Game – $49.99

This STEM-certified entrepreneur board game uses real-life scenarios to help kids ages 12 and up understand what it’s like to own and maintain a business. Players choose their own business, set their vision for expansion, and then work on accounting, branding, marketing, negotiation tactics, partnership building, risk-taking, idea creation, and more.

15. Ice Cream Empire – $34.99

This 60-minute game teaches kids the importance of building and maintaining a successful business. Players practice entrepreneurship and experience success while they compete to build a chain of ice cream stores; the winner is the one to build their eight stores first. Your Ice Cream Empire game piece is an ice cream truck that contains different ice cream flavors that you buy and sell at changing market rates. A whole host of entrepreneurial skills are learned in this game, such as supply and demand principles, calculating purchases and transactions, and how to build a business for long-term monetary success.

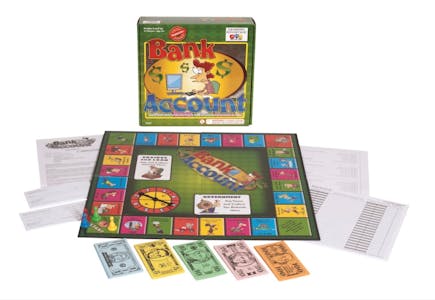

16. Bank Account – $19

This game is focused on banking principles such as writing checks, balancing checkbooks, writing a deposit slip, and withdrawing money from an account. Players also learn about tax refunds, car payments, account reconciliation, and the importance of financial record keeping. Building up strategy and critical thinking is a focus in Bank Account as well (for example, the game asks players if it is wise to take friends out to dinner before paying a medical bill). Unexpected events require players to make critical decisions regarding their bank account. The winner is the first to reach $5,000 in their checking account.

Tell us what you think