Canceling a subscription service can be super complicated, and we know companies make it this way on purpose. But really, there’s no reason it should be difficult to cancel your Prime membership or your Hulu free trial.

That’s what makes Rocket Money extra handy. Once you tell them you want to cancel a subscription, they’ll handle the entire annoying process for you.

And for any free subscription trials you’ve forgotten about, Rocket Money will track them down and prompt you with the choice to cancel them. Plus, the app offers a few money-managing features that help you save money in the long run.

Make sure to download the KCL app or text HACKS to 57299 to learn about even more money-saving tools.

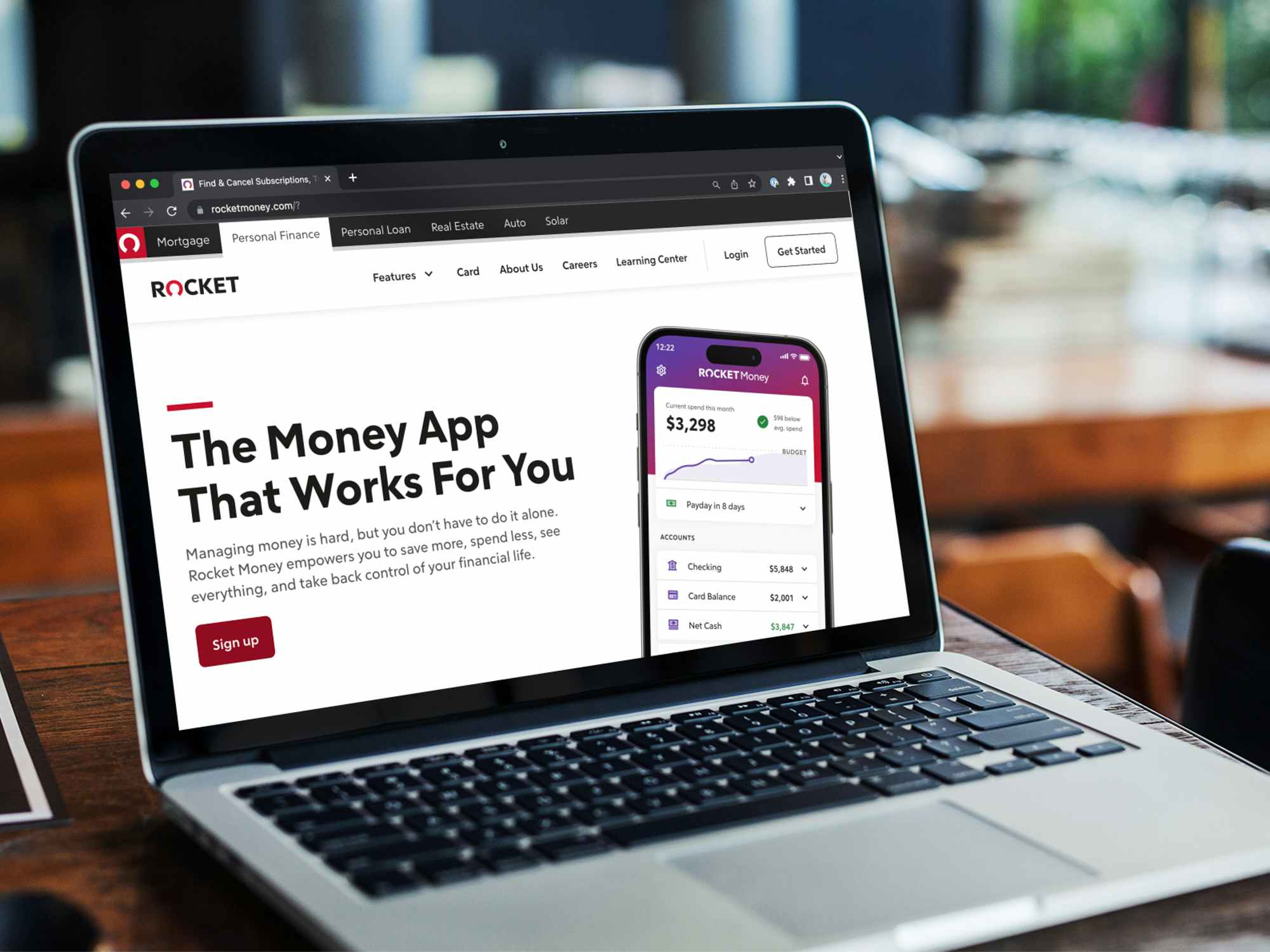

What is Rocket Money?

Rocket Money — formerly known as Truebill — is an app that helps you keep track of your finances and manage your money better. There are a ton of services included, but the belle of the ball is their subscription monitoring service. Simply link your checking account, credit cards, and any other spending accounts to Rocket Money, and sniff out those recurring charges. You might have forgotten about some of them!

How does Rocket Money work?

When you sign up, Rocket Money asks you to link your bank account, via either your checking account or your credit card statements. This might sound scary, but you login through secured access. When you link your accounts, it allows the app to track and identify your subscriptions. (It also keep track of your general spending habits, which is also quite useful.)

Once Rocket Money has identified your subscriptions, you can decide if you want to keep paying for all of them — or if you want to cancel some that aren’t actively adding any value to your life.

Sometimes you will be asked to provide a little additional information. For example, if you were canceling Netflix, you might be asked to provide Rocket Money with your Netflix username and password.

How safe is Rocket Money?

The app is owned by Rocket Companies, which also produces other well-known, reputable products like Rocket Mortgage and Rocket Loans.

Since Rocket Money is a subsidiary of a legit company, you don’t have to worry too much about your info being compromised. They work to protect your data, but they might share certain info with their advertising affiliates so they can advertise to you, which doesn’t always sound awesome when you first hear it. But it is a common practice in 2023 — read the fine print of almost any app and you’ll find the same thing.

But it’s not like they’re selling details about your bank account or investment account. Even if they’re monetizing you for ads, they’re not a company that’s going to steal your money by raiding your checking account. They don’t want to join our list of class action lawsuits, after all.

Are there any other Rocket Money features?

Yes, in abundance! On top of helping you manage your monthly subscriptions, Rocket Money can help you:

- Create a budget

- Automate your savings

- Monitor your credit score

- Track your net worth

- Negotiate your bills

That said, not all of the features are free. We’ll talk more about the fee structure in the next tip.

TIP: Don’t take the credit score feature all that seriously. Rocket Money pulls your VantageScore 3.0. Very few lenders actually use VantageScore. Most look at some version of your FICO score, which often varies quite a bit from VantageScore models. That means it’s rarely going to be a useful feature.

How much does Rocket Money cost?

There are two different tiers of Rocket Money – Lite (free) and Premium (paid). Customer service is a little scant whichever package you choose. You can only get in touch with them via chat or email. But if you’re a Premium member, you’ll get bumped up in the queue.

Here are the other big differences between the two packages.

Lite

Here are the features you get with the free Lite version of Rocket Money:

- Subscription management

- One budget with two budgeting categories

- Access to your VantageScore 3.0 credit score, updated once per month

- Access to automated savings for a $2/month fee

- Bill negotiation with a fee of 30% – 60% of your savings

Premium

Premium members pay anywhere between $3 – $12/month. Part of that will depend on when you signed up. The other factor is how much you choose to pay. It’s a sliding scale that isn’t based on income. Instead, it’s based on what you personally think the app is worth. If you pay annually, you can either pay $36/year or $48/year.

You’ll get boosted features, like:

- Automatic cancellation of subscriptions you’re not using

- Ability to create multiple budgets with unlimited budgeting categories

- Access to your full credit report. (You can also get this for free with no subscription at the government-endorsed site, AnnualCreditReport.com, once per week)

- No fees for automated savings

- Get access to the net worth tracker

You will still have to pay the bill negotiation commission, even as a Premium member.

How does Rocket Money lower your bill?

There are certain bills you can negotiate at the end of every contract period. Things like your cable, internet, or insurance are all on the table.

Negotiating your bill is something anyone can do, but it does take some time. You’ll have to get on the phone with a live agent which involves hold times, doing the little dance that is negotiation to try to get your price lower, and making sure they actually follow through on giving you the savings.

Rocket Money’s bill negotiation service does all that for you, saving you valuable time. Now, you’ll have to determine if you’d be willing to trade your time for the 30% – 60% cut of the savings that Rocket Money takes. Because there’s no way to get around paying it, even if you’re a Premium member.

The price of the bill negotiation service is one catch that turns people away from Rocket Money. On the other hand, active users love that the app makes finances easier to digest.

Is Rocket Money worth it?

If you just want to access subscription management services, there aren’t really too many cons with Rocket Money.

However, if you’re looking at the other services, there are some pros and cons. In the pros column, you’ve got:

- Access to a bunch of useful features, even at the free level

- You can pick how much you pay per month for Premium features (within a certain range)

- You don’t have to manually input any expenditures if you don’t want to — everything is synced with your financial accounts

- Many people prefer Rocket Money over Mint and Empower (formerly Personal Capital) since Rocket Money does its job in a way that’s consumer-friendly

Moving over to the cons column:

- The credit score reported is a VantageScore 3.0, which is likely a different number than potential lenders will consider

- The bill negotiation feature is cool, but it comes with a hefty commission. Depending on how scarce your time is, you could save even more money by doing it yourself

- You can expect to run into third-party advertisers after you sign up for the app

Again, while there are good and bad aspects of any product, Rocket Money can be a great tool for its subscription management features alone.

If you’re looking for an overall budgeting app or net worth-tracking app, there might be some merit in exploring other options and comparing them against your goals. Rocket Money may be a perfect app for some, but if you’re after a monthly FICO score this isn’t the one for you.

Tell us what you think