We love a good Target savings hack! And the Target Circle Card is one of the best ways to score Target Circle deals and more. You can use this card to save 5% on every Target purchase while unlocking other rad benefits. Plus, about once a month, they offer a sign-up bonus where you can snag a $40 – $50 coupon for your next Target purchase, in-store or online.

But before diving in, there are some things you should know about how to save money at Target with this card. With three different options to choose from, all of which save you 5% on your purchases, it's important to pick the one that fits you.

Before we dive into the details, be sure to download the KCL app so you won't miss any of our Target deals . Plus, check out how to read the Target clearance stickers to save even more.

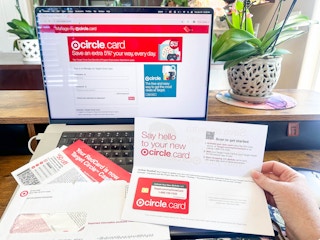

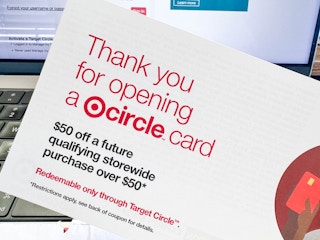

Target Circle Card Sign Up Bonus for 2024: Free $50 Coupon

Sign up for a Target Circle Card (credit or debit) now, and score a $50 Target coupon to use on your next purchase of $50 or more.

If you open a Circle Card Reloadable Account, you'll get a $50 credit when you make a $50 purchase through your account.

This promotion has been running consistently for several months in 2024, and there's currently no set expiration date for the $50 credit offer.

How the $50 Circle Card Offer Works

Once your Circle Card application gets approved, Target will mail you the coupon along with your new Circle Card. The coupon will be valid through a certain date (usually a month from the issue date). To make sure you can redeem this amazing deal, you’ll need to upload the coupon to your Target app and be enrolled in the Target Circle loyalty program.

If you sign up for the Circle Card Reloadable Account, you’ll receive a $50 credit after you spend $50 at Target. Once you receive the permanent card in the mail, activate it and spend $50 at Target within 45 days of signing up. You’ll receive a $50 statement credit within 30 days of your $50 transaction. Remember, the $50 transaction should be done in one transaction at a Target store or online. If you opt for cash back at the register, it won’t qualify for this offer.

There are exclusions to the coupon, so make sure you read the fine print.

To give you an idea of how often they do this promotion for new Circle Card users, we did some digging into past offers.

What is the Target Circle Card?

There are three types of Target Circle Cards: The Target Circle Card debit card, the Target Circle Card reloadable account, and the Target Circle Card credit card. They all offer the same perks and benefits, but they operate very differently behind the scenes — mostly in how their APR and fees work.

Option #1: Target Circle Card Debit Card

The Target Circle Card debit card acts a lot like the debit card you use with your bank account — except you can only use it at Target. You will have to link this card to your checking account before you can start spending.

Then when you make a purchase, that money will automatically be pulled out of the associated checking account.

There are no annual fees, but if you overspend and overdraft your checking account, you may end up owing money via overdraft fees to your bank. You may also end up owing return payment fees to Target, but they don’t explicitly lay out how much these fees would be for the debit card option.

The debit card and Reloadable options allow you to make a fee-free cash withdrawal at checkout. You can take out up to $40 cash, and the money will be drawn from your checking account.

Option #2: Target Circle Card Reloadable Account

The Target Circle Card Reloadable Debit card acts much like the Circle Card debit card. Instead of linking the card to your checking account, you preload your Target Circle Card Reloadable account at Target with cash.

In addition to loading the card with cash, you can get your paycheck or government benefits up to two days early when you set up direct deposit to your Reloadable account. Plus, this benefit is free.

Get a $25 statement credit when you direct deposit your tax return into your Reloadable Account by April 30, 2024. Plus, spend $25 at Target within 30 days of getting your tax refund, and you'll get an extra $5 credit to your Circle Card Reloadable Account. Check out more details on Target's Circle Card Reloadable Account page.

There aren’t many fees with the Circle Card Reloadable account. Reloading your card is free. If you want to use the Mobile Check Capture service and choose to reload your money in minutes, that can have a fee. To avoid this fee, just choose “Money in Days” instead. Also, if you use an out-of-network ATM, that will also result in a fee. You can check out all the Circle Card Reloadable information and fees here.

Like the Target Circle Card Debit card, you can get up to $40 cash back when you check out at Target. The money will be deducted from your reloadable account balance.

This option doesn’t perform a credit check. All you have to provide is your social security number to verify your identity. You also have to be over 18 and have a valid email address.

Sign up for the Target Circle Card Reloadable Debit card.

Option #3: Target Circle Card Credit Card

The Target Circle Card credit card is a type of credit card that can also only be used at Target. When you spend money on the card, you’ll have to pay in full within 25 days of the end of your billing cycle. Otherwise, you’ll owe a whopping 29.95% APR on your balance.

If you must have the credit card, make sure to pay off the balance in full every month. Otherwise, the savings you rack up through your Circle Card benefits will be completely wiped out.

Applying for a credit card can put a small dent in your credit score. However, sometimes people see this number jump back up after a few months of on-time payments. Because while new credit inquiries are negative on your credit report, expanding the amount of credit available to you often helps push your score up — as long as you’re keeping on top of those payments.

There’s no guarantee you’ll be accepted for a Target Circle Card credit card just because you apply. While the store does set its minimum required credit score quite low, you’ll also need income and a decent debt-to-income ratio to get approved. If you apply and aren’t approved, you’ll end up with that ding on your credit report with none of the positives.

TIP: Your debt-to-income ratio looks at how much money you make vs how much money you owe on debts. Many lenders like to see this number below 36%. Target doesn’t get that explicit, but under 36% is a good goal to strive for regardless of why you’re crunching the numbers.

Circle Card Perks & Benefits

All of these in-store Circle Card benefits apply regardless of whether you have a debit card, credit card, or reloadable account.

1. Get an automatic 5% off most Target purchases.

This is the big one! When you use your Circle Card, you’ll get 5% off your Target and Target.com purchases. Whether you’re purchasing household staples or splurging on Starbucks, these savings can really add up over time.

There are some exceptions you should be aware of, though. The 5% off doesn’t apply to:

-

Prescriptions

-

Target gift cards and prepaid cards

-

GameOn gift cards

-

Gift of College gift cards

-

Lottery gift cards

-

Shipt membership fees

-

Wireless protection program purchases

-

Deposits on mobile phones

-

Gift wrapping services

-

Taxes and shipping charges

-

Target Optical eye exams and protection plans

You do get the 5% off on glasses and contacts, though. And yes, the 5% off also applies to clearance items. It even applies to specialty gift cards, which means you can effectively get 5% off your Disney vacation by purchasing Disney gift cards at Target.

In most states, you can get 5% off alcohol, too, with some rare exceptions like the state of Indiana.

2. Get an extra 30 days for returns.

Target’s return policy is typically only 90 days. But when you make a purchase with your Circle Card, the return period bumps up to 120 days.

There are a few exceptions to this perk, as well:

-

Some electronics purchases

-

Target Optical purchases

-

Contract mobile phones

-

All other nonreturnable Target items

3. Get free 2-day shipping.

When you buy with your Circle Card, many orders you place on Target.com will come with free 2-day shipping. Nearly all orders will come with free standard shipping.

Depending on where you live and what you’re purchasing, there may or may not be a minimum order amount. In the past, there was a $35 minimum order threshold across the board, but there aren’t any universal rules right now that are that specific.

Bear in mind that if you’re ordering with Shipt , you could potentially run into a delivery fee.

4. Access extra Circle Card-exclusive deals.

Target doesn’t have a schedule for releasing these deals, and you might not be able to access the same ones as your friends, depending on your purchase history and geographic location.

How to Apply for the Target Circle Card

You might be offered a Circle Card application at checkout. If this happens and you consent, be sure to understand if you are applying for a debit card or credit card. A credit card application could have an impact on your credit report, whereas a debit card application shouldn’t.

To apply for the Target Reloadable account, you can only do it online. You can also apply online for the debit card or credit card options.

You’ll need basic identifying information, like your name, date of birth, and address, plus this additional info:

-

For the debit card, you’ll also need to supply information for the bank account you’d like to link to your Circle Card.

-

For the credit card, you’ll also need to provide income information on top of consenting to a hard pull on your credit.

Sign up for a Target Circle Card when there’s a $50 bonus coupon.

Target drops a special bonus offer for new Circle Card members about once per month. When you apply and get approved for a Circle Card in-store or online, you’ll get a $40 – $50 coupon to use on your next Target purchase.

While Target mostly sticks to the $40 coupon offer, we saw the $50 offer drop twice in 2023 — in August and October. This is the best time to sign up for a Circle Card to score the highest coupon value. Each Target Circle Card coupon offer usually lasts for 1 – 2 months, and your coupon is good to use for 30 days.

Is the Target Circle Card Right for You?

The most important thing to remember is that this is a card you can only use at Target. If you shop there frequently, the perks could make it a great option for you. We love it for the savings it offers frequent shoppers.

We’d recommend the debit card (or reloadable) versions over the credit card, simply because there are fewer potential negative consequences. As long as you don’t overdraft your checking account, there are no fees. With the credit card, if you miss a payment or pay late, you could end up paying sky-high interest, incurring fees, or even damaging your credit report. If you want pure protection from fees, then stick with the Target Reloadable account.

Target is a store where it’s easy to overload your cart, which is another reason we like the debit and reloadable option over the credit option. If you have any type of shopping addiction or simply make one big trip where your eyes are bigger than your wallet, the fallout can be more devastating if you’re running things as credit rather than debit.

That said, credit cards aren’t bad for all people. If you’re responsible with credit and are looking to build up your credit history, the Target Circle Card credit card is just one of many that could help you meet your goals.

Download the KCL app to add and redeem coupons in store