Yes, there are credit cards for bad credit. If you’re feeling a little hopeless because your credit score is not great, have some faith, you can rebuild. However, before opening a new credit card to spruce up your score , ask yourself why you got into trouble in the first place. For some people, a onetime catastrophic event pushed them into debt, like a medical emergency or a divorce. For others, bad credit might result from bad behavior when it comes to credit products.

With all of this being said, think long and hard before opening another card. Identify the initial problem: whether that’s overspending or simply not repaying your debts. If you haven’t actually changed your behaviors, a new credit product could end up making your credit report worse instead of better.

Most credit cards for bad credit are secured cards, which means you’ll have to put down a deposit to open your account. We’ll start with those, but there are a few unsecured options for bad credit, too.

And to make sure you have enough cash to pay your balance each money, download The Krazy Coupon Lady app for money-saving deals sent straight to your phone.

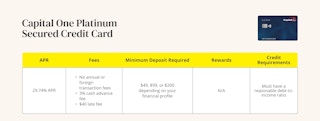

Capital One Platinum Secured Credit Card

The vast majority of credit cards available to you when you have bad credit are secured cards. These require a minimum deposit. Basically, you’ll borrow against your deposit instead of borrowing against credit from the bank.

Depending on your financial profile, your minimum deposit with the Capital One Platinum Secured Credit Card could be just $49 for a $200 credit line. This is one of the lowest deposit minimums in the industry.

Pros

-

Low minimum deposit requirements

-

No minimum credit score is required

-

Zero annual fees or foreign transaction fees

Cons

-

High APR if you don’t pay off your balance in full

-

No rewards

-

Lower deposit requirements are reserved for those with better financial profiles

Who is this card best for?

The Capital One Platinum Secured Credit Card is best for those that may have a limited or even poor credit history. Otherwise, their financial ducks are in a row. In this instance, you’re more likely to get approved for the lower minimum deposit requirement of just $49.

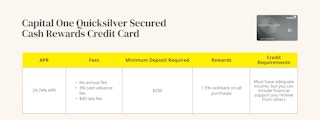

Capital One Quicksilver Secured Cash Rewards Credit Card

If you have the $200 to make a larger minimum deposit, Capital One Quicksilver Secured Cash Rewards provides a potentially better deal. You’ll get 1.5% cash back on all purchases.

Another perk of this card is that you’re allowed to count other people’s income in your application. Let’s say you’re a stay-at-home parent but you can afford to make payments because your spouse shares a joint account with you. Or you’re lucky enough to receive financial support from your parents beyond age 21.

Both of these scenarios would allow you to qualify for this card, and that’s a rarity in the industry.

Pros

-

Cash back rewards

-

You can include financial support from others, like joint bank accounts or allowances others give you on a regular basis if you are age 21 or over.

-

No annual fee

Cons

-

High APR if you don’t pay off your balance in full.

-

If you don’t have adequate income, including financial support from others, you’ll have a hard time qualifying for this card.

Who is this card best for?

This card is best for those who want to include other people’s income in their application. And 1.5% cash back on all purchases with a secured card isn’t a bad deal, either!

Related: If you’re a college student looking to build up your credit history, check out the best credit cards for college students .

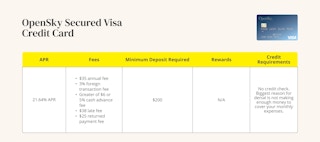

OpenSky Secured Visa Credit Card

The OpenSky Secured Visa Credit Card isn’t the cheapest option out there. It comes with an annual fee of $35, and the APR isn’t the highest, but it isn’t the lowest, either.

The biggest draw for this card is that there is no credit check required. That means even if you have negative line items on your credit report, they won’t impact your eligibility.

Pros

-

No credit check is required. If you’re worried about negative line items on your credit report, this card is a good match.

Cons

-

Numerous fees

-

No rewards program

-

APR isn’t the highest, but it’s not the lowest either

Who is this card best for?

While all secured cards brand themselves as good for those with bad credit, OpenSky means it. They go the extra mile by not even checking your credit report at all. If you have negative line items on your credit report and have been denied elsewhere, it might be worth giving OpenSky a try.

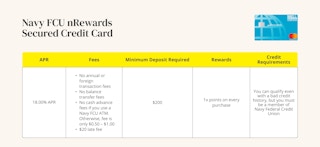

Navy FCU nRewards Secured Credit Card

The Navy FCU nRewards Secured Credit Card is great because it charges very few fees. Plus, the fees they do charge are low. Moreover, you can earn the equivalent of 1% cash back on all purchases when you redeem for merchandise or gift cards through Navy FCU. The value of points can vary if you use other redemption methods.

You’re going to need to be a member of the Navy Federal Credit Union to qualify, which means you need to have a military member in your family. This can go out two generations, so if your grandparents or grandkids served, you might qualify for membership.

Pros

-

Almost no fees, and fees are extremely low when they are charged.

-

Relatively low APR (for a credit card) if you don’t pay your balance in full. With that said, please pay your balance in full so you won’t have to pay interest at all.

-

Can earn rewards

Cons

-

Must be a member of Navy Federal Credit Union. You will need someone with military affiliation within two generations of your family in order to join.

-

Rewards points are only worth 1% cash back if you redeem for merchandise or gift cards through Navy FCU.

Who is this card best for?

This card is best for those who have a military affiliation in their family. If that’s you, you might like the low fees and comparatively lower APR.

Related: As you spend on your Navy FCU nRewards Card, be sure to take advantage of ALL the military discounts .

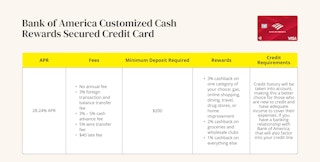

Bank of America Customized Cash Rewards Secured Credit Card

If you don’t have a credit history but you do have a banking relationship with Bank of America, this card can be a decent way to build your credit. Not only will it help you build a positive credit history when used responsibly, but you’ll also be able to earn rewards while you’re at it.

Plus, you can pick the category where you’ll earn the most rewards, customizing it to your individual spending habits.

Pros

-

Generous rewards for a secured card, though 3% and 2% cash back do max out after $2,500 in purchases for a quarter. After that, all purchases are 1% cash back.

-

If you have a positive banking relationship with Bank of America, that may help your odds of approval or the size of your credit line.

-

No annual fee

Cons

-

High APR if you don’t pay off your balance in full.

-

Particularly negative line items on your credit report may impact your eligibility.

-

While there’s no annual fee, there are lots of other fees, including a foreign transaction fee.

Who is this card best for?

This card is best for those who have a positive banking history with Bank of America but no credit history at all. It’s also good for people who want to pick which spending categories earn them the most rewards.

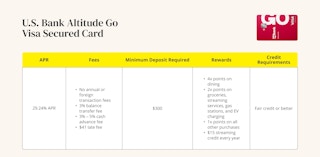

U.S. Bank Altitude Go Visa Secured Card

Unlike a lot of cards that say they will accept you with bad credit, US Bank is perfectly clear that you will need at least fair credit to qualify for the Altitude Go Visa Secured Card. Fair credit can mean a score of at least 580, but some financial institutions start the fair range as high as the mid-600s.

Other banks may say they’ll accept you with bad credit but use negative line items on your credit report to disqualify you anyways. At least US Bank is a little more transparent.

This card also offers pretty generous rewards for those who want to earn while rebuilding their credit.

Pros

-

Generous rewards, especially if you dine out a lot.

-

No annual fee or foreign transaction fee.

-

$15 streaming credit awarded on an annual basis.

Cons

-

Must accumulate at least 2,500 points before redeeming cash back. (Equivalent of $25.)

-

High APR

-

Slightly higher minimum deposit requirement compared to other secured cards.

-

Must have at least fair credit to qualify, so this card is not ideal for those who have no credit history.

Who is this card best for?

This card is best for those who have a credit score of at least 580 or maybe even a bit higher. It offers the most rewards for those who dine out a lot, whether that’s in a restaurant or by using a delivery service.

Discover it Secured Credit Card

The Discover it Secured Credit Card gives you great rewards on everyday spending. Plus, they give you a little bit of grace on your first late fee. While you can get this card if you have no credit, if you have particularly negative line items on your credit report, you may have trouble getting approved.

Pros

-

2% cash back on restaurant and gas station purchases

-

You’ll get your first year’s worth of cash back rewards doubled on your card’s first anniversary.

-

No late fee on first missed payment

Cons

-

Relatively high APR if you don’t pay off your balance in full.

-

Seriously negative line items on your credit report could get you denied.

Who is this card best for?

This card is best for those who don’t have a credit history at all and want to earn rewards. You might be able to qualify with a poor credit history, but it gets a little trickier. It’s going to depend on how long ago those negative events occurred.

Tip: Both Discover and Capital One offer refer-a-friend programs that can help you make some extra cash.

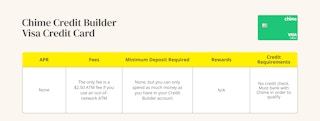

Chime Credit Builder Visa Credit Card

Technically, this is a secured card. But the Chime Credit Builder Visa Credit Card functions a lot more like a prepaid card. You’ll transfer money from your Chime Checking Account to your Credit Builder Credit Card. However much you transfer will be your credit limit for the month.

Then at the end of the month, Chime will use your balance to pay off any charges you’ve racked up during that statement cycle. While Chime does report on-time payments, it won’t report credit utilization. This is a good thing if you’re spending just as much as you’re depositing. Too much credit utilization can negatively impact your credit score.

Pros

-

This card doesn’t report credit utilization, which could help your credit score.

-

No minimum deposit amount, though you will have to deposit if you want to use it.

-

Because of the way the card functions, there is no APR.

-

The only fee is a $2.50 out-of-network ATM fee, but Chime has a network of 60,000+ in-network ATMs.

Cons

-

Must have a linked Chime Checking Account with at least $200 in direct deposits every month.

-

No rewards

-

Doesn’t function like a traditional credit card, so it doesn’t help you practice good habits in the way you’ll need to when you graduate to an unsecured card.

Who is this card best for?

This card is best for those with bad credit card habits who struggle to pay their bill at the end of the statement cycle. The way it’s built means you won’t be able to spend more cash than you have on hand, though you also won’t get practice using a credit card responsibly. It’s only available to Chime Checking Account users, so you’ll have to meet that bar first.

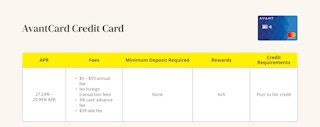

AvantCard Credit Card

The AvantCard Credit Card is the only true unsecured credit card to make this list. It’s best for those with poor to fair credit, so you can qualify even with a negative credit history.

Depending on how negative your credit history is, you might be charged an annual fee of up to $59. Because this card is unsecured, you won’t have to put down any deposits if you qualify.

Pros

-

No deposit is required; this is not a secured card.

-

Available to those with poor to fair credit.

-

Some applicants will be offered a $0 annual fee depending on their credit profile.

Cons

-

Other applicants will have to pay a $59 annual fee.

-

No rewards

-

High APR if you don’t pay off your balance in full.

Who is this card best for?

This card is best for those with bad credit who want an unsecured credit card; no security deposit is required. Be careful, though, the APR is high if you don’t pay off your balance in full. If you don’t use this card responsibly, your credit could end up in a worse place than when you started.

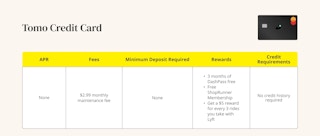

Tomo Credit Card

The Tomo Credit Card is another unsecured credit card, but it functions a little differently. You absolutely have to pay your balance off in full every month, otherwise your account will be frozen. A frozen account can lead to negative line items on your credit report.

This card is best for those with no credit history at all, particularly if you’re new to the U.S. banking system. Most cards require citizenship, but all you need with Tomo is an SSN or ITIN.

Pros

-

You don’t need to be a U.S. citizen to qualify, though you will need either a SSN or ITIN.

-

No credit history is required, but your financials will be reviewed prior to approval.

-

There is no APR or fees.

-

No deposit is required; this is an unsecured credit card.

Cons

-

There is a wait list for the Tomo card.

-

You can’t carry a balance from month to month. This is good for building good financial habits but bad if you want to make a minimum payment and still be able to use the card moving forward.

-

If you don’t pay your balance and your account is frozen, this could lead to a negative line item on your credit report.

Who is this card best for?

This card is best for those starting from scratch, particularly immigrants and foreign exchange students with an SSN or ITIN. It’s also imperative that you’re someone who will pay off your balance in full every month.

Download the KCL app to add and redeem coupons in store