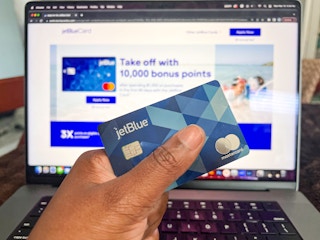

JetBlue offers two branded, personal credit cards through Barclays that can help you earn TrueBlue points to fly for free. There’s the standard JetBlue card, which comes with no annual fee, but is also missing some pretty huge perks. Then there’s the JetBlue Plus card, which does have a stubbornly persistent annual fee but gets you a full suite of travel benefits, plus increased rewards on your purchases.

If it’s the perks you’re after, you’ll probably be served by paying the $99 annual fee, especially during the first year. After that, your rewards could help you cover the annual fee. However, in most cases you’ll have to travel with JetBlue a lot (like, really a lot) to make that happen.

The JetBlue card won’t be right for everyone simply because JetBlue doesn’t fly everywhere. If they don’t touch down at your home airport, you’ll want to look at other travel credit cards.

But there’s a subset of people who could benefit. Let’s delve in to see which side of the coin you’re on.

Download The Krazy Coupon Lady app for more frugal travel tips.

JetBlue Credit Cards Overview

Applying for a new credit card may put a (usually) small ding on your credit. If you get approved, this is typically NBD because using your card responsibly is likely to move your score up enough to more than make up for the difference.

But if you get denied, you’ll have incurred that decrease in credit score for nothing. So you want to make sure you’ll qualify before you apply.

JetBlue usually requires excellent credit for both cards. However, there are reports of people with merely “good” credit getting approved, too. Generally speaking, your odds of approval are much higher with a credit score of 700 and up. Still, a smaller number of people have gotten approved with a score of 660 and up. You’ll get the absolute best odds of approval with a score of 750 and up.

Your credit score isn’t all you should consider, especially if you’re on the cusp. Make sure you’re pulling in enough money to cover your living expenses and debt. Usually you should aim for a debt-to-income (DTI) ratio below 30%.

Which JetBlue credit card is better for me?

That all depends on how much you want or need to save on your JetBlue flights. While the JetBlue card doesn’t come with an annual fee, it’s also missing a ton of perks that come with the JetBlue Plus card. These include free checked bags and meaningful differences in how many points you can earn.

JetBlue Card

There’s no annual or foreign transaction fees.

The absolute biggest pro to the JetBlue Card over the JetBlue Plus Card is that it comes with no annual fee.

Both cards don’t have foreign transaction fees, which is great if you travel internationally.

You will have to pay balance transfer fees, which are the greater of 5% or $5. While it’s rarely a super great idea to take out a cash advance, the cash advance fees on both cards are a tad high at the greater of 5% or $10.

The rewards on the standard JetBlue card aren’t bad.

Even though the rewards on the standard JetBlue card aren’t as high as the ones offered through the JetBlue Plus card, they’re still not bad for an airline card. Especially because it offers slightly higher rewards for grocery and dining purchases. That’s not incredibly common for a travel card.

You’ll earn:

- 3 points for every $1 you spend with JetBlue.

- 2 points for every $1 you spend at restaurants and grocery stores.

- 1 point for every $1 you spend everywhere else.

One thing to pay attention to is that you can only use your points to book travel with JetBlue, or in some cases, their partner Hawaiian Airlines.

Point value varies depending on flight, but usually they fall somewhere in the $0.013 – $0.016 range.

Minimum spend for the introductory offer is achievable.

The introductory bonus offer is 10,000 points when you spend $1,000 in the first 90 days. That’s a pretty low bar to hop as far as credit card sign-up bonuses are concerned.

Ten thousand points are worth about $130 – $160 in redemption value, so this could earn you a free, short-haul flight. But if you want to go cross country, you’re probably going to need to save up your points a little more.

TIP: Get in touch with JetBlue credit card customer service by calling Barclays at (866) 928-8598.

There is an introductory 0% APR offer for balance transfers.

If you make a balance transfer within the first 45 days of account opening, you can score 12 months of 0% APR on the balance.

Unfortunately, you’ll still have to pay balance transfer fees, which many other credit card issuers waive when there’s a 0% intro APR offer. If you’re trying to score 0% APR for these purposes, you might want to go somewhere else.

APR for purchases is high, even for a credit card. This is a little frustrating because this card does require a decently high credit score. But you can avoid paying interest if you pay your statement off in full each and every month.

If you take out a cash advance, you’ll pay 29.74% in APR, and the interest will start charging right away. You don’t get to wait until the statement is issued like you do with regular purchases.

JetBlue credit card perks include 50% off in-flight food and drink.

While the travel perks are limited compared to the JetBlue Plus card, the standard JetBlue card does give you 50% off in-flight food and drink. Which is great, but it’s JetBlue. So you’re almost sure to end up paying another fee somewhere else that’ll eat into that savings.

You won’t get a free checked bag with this card.

JetBlue doesn’t give you a free checked bag with a standard credit card. This is bizarre for an airline card because that’s usually a standard feature.

Related: JetBlue Airline Tips That Will Save You Hundreds

JetBlue Plus Card

There’s a $99 annual fee on the JetBlue Plus credit card.

The absolute biggest bummer with the JetBlue Plus card is that it comes with a $99 annual fee. Not only that, but the fee isn’t waived for the first year. That is atypical for a travel credit card. You’ll need to pay it before you can unlock any of your card’s features.

All the other fees are the same as the standard JetBlue card, including the lack of foreign transaction fees.

The same introductory APR offer applies.

JetBlue Plus also comes with identical APR offers as the standard option, including that 0% APR on balance transfers. But like we talked about, that offer isn’t good enough to be attractive.

The JetBlue Plus credit card comes with beefed up introductory offers and rewards.

Where does the JetBlue Plus card shine, then? It’s all about the rewards.

First, instead of 10,000 points on the introductory offer, you’ll get a bonus of 60,000 points for meeting the same minimum spend of $1,000 in the first 90 days. I cannot stress enough how big this difference is.

It puts your redemption at $780 – $960 if you’re redeeming for JetBlue travel, allowing you to book longer flights for potentially free.

Then there’s the everyday rewards. The grocery and “everywhere else” rewards are the same as the standard card. But when you spend money with JetBlue, you’ll earn a whopping six points per every $1 spent rather than just three.

Related: How to Fly to Disney for Free

You get extra travel benefits with the JetBlue Plus card.

It’s also all about the travel benefits. When you choose the card that requires an annual fee, you actually will get a free checked bag on every flight. Plus, up to three people traveling with you will get their first bag checked for free, too!

You’ll also get:

- $100 statement credit when you spend $100+ on a JetBlue vacation package

- 50% off in-flight food and drink purchases

- Bonus of 5,000 points every year on your card anniversary

- 10% of your points back when you redeem for JetBlue flights

This card lets you redeem your points as cash back.

Don’t want to redeem your points for a flight? The JetBlue Plus card actually allows you to redeem them as cash back statement credits, up to $1,000 per year.

You gotta know that when you do this, each point will be worth less money. Right now, cash-back redemption comes out to about $0.0075 per point. So you’d need 3,333 points for every $25 you wanted to redeem.

Here are some other perks of JetBlue credit cards.

It doesn’t end there! There are some unique perks of JetBlue’s rewards program that make it more attractive than other airlines. Of course, this is only as long as JetBlue actually offers flights out of your home airport.

Your points never expire.

Unlike most airline point programs, your JetBlue TrueBlue points won’t expire if you leave your account inactive for a while. They never expire, so they’ll be there whenever you’re ready to use them.

You can book with a mix of points and cash.

Usually when you redeem points or miles with an airline, you’ve gotta pay for the entire flight with either cash or points.

But JetBlue allows you to mix things up. So if you’re 2,000 points shy of having enough for a flight, you can make up the difference in cash money.

TIP: You still have to pay taxes and fees in cash, whether you’re booking your ticket with points or not.

There are no blackout dates.

If you’ve ever booked rewards travel with a big airline, you know that it can be a massive pain. There are often blackout dates, only a set amount of rewards seats per flight, and you might not be able to book everyone’s seats together.

JetBlue eliminates all this friction by making your points redeemable for any seat on any flight. No blackouts. No set number of rewards seats per flight. You can go wherever whenever.

Fly better with Mosaic status

The JetBlue frequent flyer program is in flux, but for right now, it’s still called Mosaic. Mosaic comes with a lot of extra benefits, like:

- Get 2 free checked bags per flight.

- Earn 3x the points on your JetBlue purchases.

- Get 2 free checked bags on American Airlines flights, too.

- Early boarding (woot!)

- Get free inflight alcohol. (Party flight!)

You can get Mosaic status by racking up 15,000 TrueBlue points on your purchases. That means the 6x, 3x, 2x, or 1x points you earn when you spend money on your card. The points you earn through the introductory offer or anniversary bonuses won’t count.

Who is the JetBlue card best for?

You’ve gotta love JetBlue and fly with them a lot for this card to be worth it. JetBlue only flies out of select cities to select destinations, so it has to be convenient for you, too.

While there is a cash-back statement credit redemption option for JetBlue Plus cardholders, the value of each point when you redeem it this way is low. Consider other cash-back credit cards if that’s what you’re after. There are much better offers on the market.

You also have to meet some pretty high credit standards just to qualify. If you check all of these boxes, though, you will have opportunities to book flights hassle free with no blackout dates or seats. And this goes for whether you pay entirely in points or not. That in and of itself is a pretty big draw.

Download the KCL app to add and redeem coupons in store