Whether you’re wondering how to save money for a rainy day, to pay off bills, or just to give yourself some breathing room between paychecks, we’ve got 100 ways to cut back that you may not have thought possible.

Of course, sometimes cutting back on spending habits can bring a bit of temporary pain. You may have to leave something in your shopping cart or hold off on buying something you really want. But in the end, if you practice these tips, spending less can become a habit which, according to experts, takes an average of 66 days to form.

To get your budgeted spending to total less than your income, you need to look at steps, however small, that can help you spend less — from entertainment to shopping — and still live your best life within your means. Here are simple ways to spend less money, starting today.

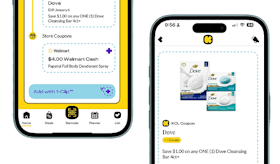

Download The Krazy Coupon Lady app for the latest deals, tips, and money-saving coupons.

How to Spend Less Money: 101 Ways to Get Started

How to Spend Less on Entertainment

If you’re like most Americans, you don’t realize how much you spend on entertainment. But saving in this area is one of the easiest to follow through on because these items aren’t necessities (even if they feel like it).

1. Take Free Classes

Most colleges and community centers will offer free classes to the public as part of their enrichment and outreach programs. Since the pandemic, many stores are offering free online classes as well. Learn to craft, garden, and even take some yoga free from home!

Related: 30 Free Things You Can (Almost) Always Get Your Hands On

2. Find Local Free Events

Every town and city will have free events listed online for the public to attend at parks, libraries, and public green spaces. From gardening classes to storytime for kids, local events are easy to find online and will help you spend less on entertainment.

3. Moonlight at Venues

If you can’t afford to see concerts but love the arts, volunteering or working part-time for the local theater or venues can help you see events for free. Plus, you could also earn a paycheck or other perks.

4. Get Cheaper Tickets With Deal Sites

When local venues and restaurants need to fill seats, they’ll utilize deal sites like Groupon or Living Social. You can snag deals on resorts, local concerts, cooking classes, and restaurants. See dining and restaurant coupons here.

5. Set Up Price Alerts

When is the best time to buy plane tickets? Well, setting up alerts with travel sites like Kayak and Airfare Watchdog far in advance will help you spend less on airfare. You’ll get daily roundups of great deals on vacation locales if you’re not picky about the destination, but you can also set up price alerts for any city to help you save.

6. Snag Season Passes

For your local aquarium, zoo, or museum, a season pass may pay for itself even if you use it just a few times in a year. These passes can also sometimes include discounted parking or meal tickets to make your visits even cheaper!

How to Spend Less on Travel

It’s easy to overspend when on the town or out of town. These tips should help reign in a few extra bucks.

7. Use Your Credit Card Points

By using credit card points wisely, you can use travel rewards to travel for free. After racking up some sign-on bonuses, you can cash in your points for hotels, rental cars, and excursions.

8. Travel Off-Season

Supply and demand will make prices rise. If you can get time off, figuring out the shoulder season for any location you want to visit will save you lots of cash. Every destination has a peak season where prices are highest and a shoulder season where the weather is still great but fewer people are booking.

9. Travel During the Week

If you can avoid flying out on the most popular days to travel, namely Friday through Monday, you spend less money on travel. Hotels, rental cars, and airfare are typically cheaper during the week.

10. Get Creative With Lodging

If you’re traveling, you can spend less on hotels by comparison shopping between sites like VRBO, Airbnb, and hotel websites.

11. Utilize Hostels

Hostels aren’t just for college kids. Some hostels are family-friendly and offer private rooms for a fraction of the price. If you’re traveling with several kids, booking at a hostel with a private room can save you hundreds.

Related: 30 Brilliant Budget Friendly Vacation Tips & Tricks

12. Book Hotels With Free Breakfasts

Many hotels offer free breakfasts, which can help you spend less money when you travel. Your hotel should have this amenity listed online, so be sure to see if the place you’re staying offers free breakfast.

13. Eat Lunch, Not Dinner

While traveling, it might be tempting to stay out late and enjoy dinner in a new place. If you’re looking to spend less money while traveling, you can still enjoy the local fare but will save more by opting for lunch instead of dinner. Daytime prices are often much cheaper.

14. Play Local Tourist

Spend less on travel by taking a staycation for a day, a week, or a weekend. Have you hiked all your local trails? Tasted the beer at all the new breweries? Could you take a historical tour? Many of these activities can be cheap or free.

15. Avoid Baggage Fees

When you travel, the more you pack, the more you pay. For many airlines, you’re allowed one to two carry-on items, and checked baggage can be $50 USD per bag. Doing laundry at your destination or packing light can help you spend less on your next vacation.

16. Eat in Your Hotel Room

Eating at least one meal at your hotel room can help you spend less when you take your vacation. Booking a hotel with a kitchenette can be great, but even something simple like a cup of soup or a sandwich can be a money saver. Often these meals can be made with as little as a coffee maker for hot water, a microwave, or small fridge.

17. Get Creative With Dining

Restaurants are not the only place you can experience the cuisine of a new place. Plan at least one picnic wherever you travel. It’s a unique way to slow down and savor your destination with a day at the park or on the beach.

18. Skip on International Plans

Do you need to make phone calls when you’re traveling internationally? Skip out on the $10 a day (or more) international plans and use Wi-Fi to access your data and make calls. You can use free services like Google Voice or WhatsApp for any voice calls.

19. Travel for Free With the Companion Pass

If you love Southwest Air and are planning a lot of domestic flights, you can earn the Southwest Companion Pass. The Companion Pass will enable you to get a free flight for someone to tag along on your next trip!

20. Try Ridesharing Instead of Renting a Car

Public transportation is often the cheapest when you travel, but you save even more by trying ridesharing sites like Turo to rent from individuals instead of car companies.

21. Switch Up Your Airport

If you’re looking to spend less on airfare, try flying out of a different airport. You can also save more on longer flights if you fly into a major hub. Play tourist for a day and finish your flight from a major airport to spend less on your trip. Each airline has different hub cities, so be sure to look them up before you book for a better deal.

How to Spend Less on Food

Food is an easy area where extra spending sneaks its way into overspending. Try some of these tips to lower the bill during checkout.

22. Skip the Drinks

Dining out can be an awesome treat, but cocktails or a glass of wine can easily be the same price as an entree. If you’re looking to spend less when you’re dining out, the easiest way is to skip the drinks. Water with lemon is free!

23. Meal Prep Each Week

According to Forbes, families waste over 31.9% of their food each year. By learning how to meal prep for your family, you can cut down on food waste and, of course, spend less money on food. Prepping at least one meal for several days at a time can save you time and money.

24. Shop the Store Brand

Most stores use a process called “white labeling” when building out their store brand products. Many times, your grocery store’s brand will cost a lot less, but the items are sourced from the same supplier as the name brand.

25. Eat Less Meat

The price of meat has been skyrocketing lately. If you can ditch meat for just one day a week, you can spend less on food each week. Planning for a “Meatless Monday” each week can help you cut down on that grocery bill!

26. Shop Your Kitchen

Chances are, you’ve stocked up on some great deals, but they’re languishing in the back of your freezer or pantry. Every quarter, making it a point to rotate your stock and bring the oldest items to the front, ensuring they’re used before expiring, can help you spend less. Chances are you already have what you need to make a great meal, but it might be hiding in the back of your freezer!

27. Bulk Your Meals Up With Fillers

Get more mileage out of your meals by incorporating staples like rice and beans as sides or folding them into the recipe. These items can be purchased in bulk for pennies a pound and have a great shelf life. This is one of the easiest ways to stay satiated without going broke!

28. Buy Frozen Whenever Possible

Save time and money at the grocery store by stocking up on frozen fruits, meats, and veggies. Not only do these items have a longer shelf life and are easier to buy in bulk, but they generally cost 20 – 30% less than fresh.

29. Avoid Chain Groceries

If you haven’t been finding good deals at your local grocer, try finding new ways to save on produce. Switching up where you shop and experimenting with discount stores like Aldi or local grocers can help you stock up for less.

30. Buy Groceries in Season

If you like to stock up on fresh fruits and vegetables, buying them in season will yield tastier picks but also cheaper prices. Additionally for items like hams, turkeys, hot dogs, and lunch meats, you can save more when grocers stock up for major holidays.

31. Utilize Your Grocer’s App

Have you seen fewer coupons on shelves? Most grocery stores are going digital and are only offered in the mobile app for your favorite stores. Digital coupons can help you save at the register, and you can clip them for both in-store and curbside orders.

32. Calculate the Price per Unit

You’d be surprised that club packs and larger boxes aren’t always the cheapest. Many retailers now include the “price per unit” on their shelf tags. You can see how much an item costs by packet, ounce, or pound. If not, do the math to ensure you’re getting the best price possible.

33. Pack Snacks & Beverages

Whether you’re traveling or simply running errands, buying bottles of water and snacks can add up. Utilizing a reusable water bottle or silicone sandwich bags for snacks can help you spend less. Invest in a few reusable containers to save on food and drink.

34. Kids Eat Free

There are more than 30 major chains where kids eat free, usually with few restrictions. If you’re hoping to spend less on a night out, be sure to check the list.

35. Prep Your Food Properly

When you get your food home, are you utilizing it properly? Learning how to properly prep and store your groceries can prolong their shelf life and cut down on food waste.

36. Learn Fridge & Freezer Hacks

Learn to make the most of your fridge and freezer to get every penny of value out of your grocery budget. If you find that items are going to waste in your fridge, making your storage more efficient will make meal prep even easier.

37. Avoid Convenience Foods

The less work you have to do in preparing your meal, the more it’ll usually cost. Convenience foods like precut fruits, sliced cheese, and premade deli sandwiches will cost more than doing a little bit of work yourself.

38. Buy Snacks in Bulk

Individually wrapped snacks like chips and trail mix are very convenient but not the cheapest. Buy items like chips, granola, yogurt, cereal, and dried fruits in bulk. When you do your meal prep for the week, setting aside snacks in small bags or reusable containers will help you spend less on snacks between meals.

39. Stock Up on Shelf-Stable Items

Some foods just have a better shelf life than others, so it’s great to stock up. Of course, there are also some foods that almost never go bad that, if stored properly, will beef up your stockpile.

40. Co-Op Your Meat & Bulk Items

Depending on where you live, you may be able to purchase a whole cow and pay for it to be processed to freeze. If that’s not an option, you can still collaborate with a neighbor or friend to buy in bulk for cheaper prices on meat and shelf-stable items.

41. Co-Op Your Meals

If you’re practicing bulk purchasing with a neighbor or friend to spend less on food, why not take turns prepping meals? Cooking meals in batches and swapping meal duty can also help you spend less. Double up a recipe and take turns sharing casseroles, soups, and other dinners!

42. Shop the Top & Bottom

When you’re in the grocery store, the products at eye level are priced at a premium. Grocery stores know that most of us don’t stray when it comes to shopping, so look above and below for better value and an assortment of products you need.

How to Spend Less on Living Expenses

Living expenses are some of the hardest to cut back on, but when you do, it can make a big difference in your savings.

43. Negotiate Your Medical Bills

Medical bills can be stressful, but you may be able to negotiate. Ask for an itemized receipt from any hospital or doctor’s visits, and first ensure that there aren’t any mistakes with services or insurance coverage. If all is correct, call your provider and ask if you can negotiate. It may not always be successful, but you can avoid costly mistakes with a quick review and call.

44. Cancel Your Subscriptions

Every year it’s a good idea to go through any subscriptions you have for services or goods and unsubscribe before they renew. You can check your credit card statements for any auto-renewals, and be sure to call them in before they roll over!

45. Negotiate Your Lease

Taking on a longer lease or asking your landlord how you can take advantage of any discounts may get your rent down. If you’re renting a room or a house from a private landlord, you may be able to get a cheaper rate by taking on maintenance tasks.

46. Auto Insurance

Shopping around for auto insurance every year when it’s time to renew can help you spend less on transportation. Calling your broker after you get some online quotes can help you negotiate a cheaper rate. If that doesn’t work, you’ve done all the research to switch to something cheaper.

47. Negotiate Your Insurance Rate

Have you double-checked that you get all available discounts? Would you save more if you combine your home and auto insurance into one policy? Are you a student? Call your insurance broker to see if there are any bonuses or discounts you might qualify for.

48. Shop Around for Car Maintenance

Save money on basic maintenance like oil changes and tire rotations; taking a few minutes to call around for rates can save you hundreds. Most express lube places will offer coupons online or by signing up for emails.

49. Save Money on Car Tires

Car tires can be a big purchase and cost a few hundred dollars every few years. You can comparison shop with different retailers but can save a lot by utilizing rebates. Additionally, if you snag a great deal on tires, you can find out what shops can install them the cheapest to save even more. Have an oil change coming up? Oil change coupons for the win.

50. Pay Cash for Discounts

Many doctors and veterinary offices will offer a discount if you’re willing to pay cash. For services you use regularly, you may be able to save 5 – 10% on your bill by paying cash. Just ask!

51. Switch to Automatic Payments

You may be able to save on your monthly bill by switching to automatic payments. Your cell phone provider, cable, or water company may give you a kickback for scheduling auto payments.

52. Share Your Accounts

Family plans can help you spend less. By bundling accounts for various members or packaging services, you can save on your phone bill and other utilities. Your phone and streaming services may offer a family plan that can save you more!

53. Skip on Extended Warranties & Insurance

While it’s tempting to insure your new smartphone or laptop, often these plans are expensive with giant loopholes. Most gadgets you buy have a decent warranty on their own, so with reasonable wear and tear, if a product fails prematurely, you should be protected for free.

54. Weatherproof Your Windows

If your utility bill is making you sweat, cover your windows. Windows and doors can be reinforced with curtains and weather stripping to ensure you’re not losing money. You can reduce your heating bill by 20% or more by utilizing blackout curtains in the summer and reducing drafts with coverings in the winter.

55. Get Rewarded for Conservation

Are you aware of all tax credits and assistance programs for your city and state for home improvements you make? Your state may incentivize programs like solar panels, insulation, and other energy or water conservation projects you can do around the home with a credit or rebate.

56. Apply for Local Programs

If you’re about to tackle some projects around your home to reduce your energy or water consumption, there may be a program or grant to cover home improvements. You may be able to get free LED bulbs, cost reductions on weatherizing your home, or vouchers for low-flow toilets.

57. Cut Laundry Costs

Do you know how much detergent to use? Using too much detergent not only wastes money but can wear down your machine. The hardness of your water, the type of washer you have, and the type of detergent can greatly impact how much you need. See this handy detergent guide from Tide to measure appropriately and reduce waste.

58. Regularly Tune Up Your Appliances

When was the last time you cleaned your dryer vent? Have you ever changed your washing machine filter? Doing an annual tune-up of your appliances can help you spend less on electricity and prolong their life. You can find easy tutorials online for every machine in your home or refer to the user manual.

59. Invest in a Smart Thermostat

Upgrading your thermostat may cost some money up front, but it’ll pay off quickly. Being able to set your heating and cooling on schedules is easy to set up; plus, you can control your usage from afar. Never worry about heating an empty house again!

How to Spend Less While Shopping

If you’re a shopaholic, these tips may test you. However, if you persevere, congrats! Reducing what you spend shopping may also reduce what’s cluttering up your closets.

60. Seek Out Discounts

Many companies offer teacher discounts, first responders discounts, military discounts, and of course, student discounts. Many companies offer a one-time discount after you verify your status, while others offer a coupon code. If you can’t find information, email customer service.

61. Snag Your Birthday Freebies

Your birthday comes but once a year, so you better enjoy these birthday freebies at your favorite restaurants and shops. Get free cookies or some sweet discounts on your special day at over 100 major retailers.

62. Rack Up Freebies

Getting freebies isn’t just reserved for your birthday! Chances are you’re missing out on freebies all year long. From samples to full-sized products, you just have to know where to look to get free stuff!

63. Join AARP

If you’re over 50 years old, you can rack up discounts at a variety of retailers. With an AARP membership, you can save at various chains like Walgreens, the UPS store, and AT&T for around $12 a year.

64. Subscribe & Save

Many online shopping sites now offer discounts by signing up for subscriptions on your favorite products. Often, you can tailor these deliveries to meet your needs from weekly, to once or twice a year. Even if deliveries are paced out, you can still get a 3% – 10% discount on products you buy regularly. From toilet paper to dog food, if you know you’ll buy it again, subscribe!

65. Buy Quality Generics

From batteries to pregnancy tests, knowing when you’re simply paying for the name brand is key to spending less. Amazon has a variety of knockoffs in their Amazon Basics line. Figure out which items you should stop buying and buy the Amazon version instead.

66. Rack Up Credit Card Rewards

If you’re looking to rack up credit card rewards to get free travel, you can be wise about where you charge on your credit card. Each card will have categories where you can get extra points when you spend — usually travel, restaurants, and gas. Check in with your card provider regularly, as you can find temporary bonuses with specific retailers.

67. Get on Email Lists With a Spare Account

Setting up a throwaway email account just for marketing emails will save your sanity and your money. You can get great deals with flash sales and anniversary sales without inundating your main inbox and still waiting for the best deals.

68. Skip the Stores

It’s nothing new that online-only brands, also known as “direct-to-consumer,” are seeking to disrupt the status quo! Shopping online for big-ticket items like glasses, contact lenses, mattresses, and even retainers will help you cut out the middleman (retailers) and help you spend less, since they specialize in one item and are only available online.

69. Watch Out for Amazon Prime Day

Prime Day is usually a blowout for most people who love to shop online. To compete, many major retailers will also offer huge savings around this time to compete against this giant.

Related: Here’s what we know about the second Prime Day sale of the year taking place in October.

[wp_ad_camp_6]

70. Know the Best Time to Buy

Many major retailers will have annual or semiannual sales to celebrate an anniversary or drive up sales during their slowest times of the year. For instance, Nordstrom has an Anniversary Sale every summer. Bath & Body Works has their Semi-Annual Sale twice a year, around June and December. Ulta has 21 Days of Deals each year around late August.

71. Shop With Discount Gift Cards

Gift cards are a popular choice for the holiday season, but you can also rack up a few for your yearlong purchases to spend less overall. Shop around for discounted gift cards that others have traded in and save up to 60% on gift cards from your favorite stores.

72. Use Your Amazon Prime Perks

Did you know that Amazon Prime members also get free books with their Prime Membership? You can also get discounts up to 20% on your recurring purchases with subscriptions and a plethora of free movies.

73. Utilize Trade-In Programs

From video games to car seats, many major retailers offer trade-in programs for you to upgrade your old items to new ones. Get coupons or store credit for trading in your car seats at Target, old consoles and games at Game Stop, and smart home devices at Amazon. You can spend less if you’re ready to upgrade!

74. Shop During Tax-Free Weekends

Are you in one of the 18 states that offer tax-free weekends? At the end of summer, you can shop tax free and get anything from school supplies to laptops without any state sales tax if you time it right.

75. Shop for Deals Off-Season

Buying swimwear and patio furniture at the end of summer can be the best way to save on items you’ll need next year. The same goes for snow boots, cold weather gear, and school supplies. For items you may not need now, if you can store them for a season, you’ll save!

76. Buy Holiday Decorations the Day After

Never pay full price for wrapping paper, Christmas lights, and decor. Shopping the day after a major holiday will yield the biggest discounts, especially for items you’ll use the following year — like gift bags, tissue paper, and gift tags.

77. Build a Coupon Stockpile

The best deals aren’t just for extreme couponers. Learning how to build a coupon arsenal can help you snag amazing deals on household essentials, pet products, beauty, and more.

78. Take Advantage of Price Matching

When you’re shopping at a brick-and-mortar store, be sure to check to see if you can get a better deal elsewhere. Some retailers have a better price on their own website than they do in person and will price match. Be savvy on each store’s price matching policy when you’re out shopping.

79. Swap Brands

We’re creatures of habit, but by switching stores and even brands, you can spend less each time you shop! Especially as prices rise, by leaving your loyalty at the door — especially when it comes to household stock-up items like laundry detergent and toothpaste — you can save!

80. Utilize Facebook Marketplace

While thrift shopping can be hit or miss, you can guarantee you’ll find what you’re looking for on Facebook Marketplace. From furniture to baby strollers, you can find what you need at a fraction of the price. Some items may need to be picked up, but others can be shipped.

81. Maximize Your Costco Membership

There are more perks than cheap hot dogs at Costco! Executive Members get a 2% reward on all purchases plus special discounted services, but even if you haven’t upgraded, members can rack up steep savings on tires and vacation packages you can’t get elsewhere.

82. Shop Liquidation and Salvage

What does your store do with things they can’t sell? They send stock to liquidation and salvage stores. Stores like Anthropologie and HomeGoods have outlet stores with crazy markdowns, and you can score steep deals at the Target Salvage store. Simply Google “salvage” or “outlet” to find stores near you.

83. Utilize Credit Card Bonuses

If you’re smart about your credit, you can utilize sign-on bonuses and perks with store-specific cards. Sign up for the best store credit cards for exclusive offers and ongoing discounts. Some credit cards will offer better perks for grocery purchases, so having a few based on your spending habits can help you spend less.

84. Purchase Refurbished Tech

From Roombas to iPads, purchasing your tech refurbished from a trusted retailer can help you spend less. Most major appliances, from KitchenAid stand mixers to Ring doorbells, are available at a discounted price. Better yet, snag these during a flash sale or Black Friday for even better bargains.

[wp_ad_camp_7]

85. Utilize Cash-Back Apps

On top of the store’s apps, you can also save with cash-back apps like Ibotta for cash back on purchases you make at the grocery store. Utilizing rebate and cash-back apps regularly can help you stack savings.

86. Join Facebook Groups

Every major retailer will have a Facebook group of people who stalk for deals and know which coupons will stack to spend less money each shopping trip. For stores you frequent regularly, joining these groups will help you find the best deals if you can’t keep up with the sales.

87. Utilize the Return Policy

Not only can you save by purchasing a store brand, but these products are often backed with a money-back satisfaction guarantee, even if consumed. You can return it if you don’t love it, so there’s no risk.

88. Avoid Credit Card Processing Fees

For large, ongoing purchases, like college tuition or mortgage payments, you might be wise to avoid the credit card and pay with direct deposit to avoid a 2% – 3.5% fee to use your card. Also, be sure to check your utility bill to see if you’re being charged a small markup for paying with a card.

89. Referral Programs

Think of all the shops and services you frequent — do any of them have referral or affiliate programs? Many businesses and services can give you a kickback in the form of a discount or store credit for referrals to friends and family.

More Ways to Spend Less Money

We even found some random ways you can earn or spend less money.

90. Donate Blood or Plasma

Not only can you help others in need, but you likely can get free vouchers, gift certificates, and passes for donating your blood or plasma. If you’re able to spend an hour in a chair, you can sometimes walk away with a free pass to local attractions and fast-food gift cards.

91. Volunteer

Volunteering for local organizations can help keep you busy, but there are often additional perks. Depending on your cause, you may get into events for free — especially if they’re tabling at local fairs and festivals.

92. Get Free Books

If you’re a passionate reader, there are dozens of ways to get free books beyond just going to the library. From book exchanges, free book giveaways, and getting free books to review online, you can make an adventure of finding new books for free.

93. Take a Spending Challenge

If spending less isn’t exciting for you or your family won’t get on board — make it a game! Turn spending less into a challenge with weekly or monthly themes around packing lunch or canceling subscriptions; there are plenty of spending challenge ideas around. Make a game of it!

94. Get a Discounted Gym Membership

Many gyms offer new sign-on bonuses, free trials, and other perks if you’re a new member. If you’re looking to start working out or have been for a while — be sure to shop around to get the best deals on gym memberships.

[wp_ad_camp_8]

95. YouTube Your Workouts

What’s better than a cheap gym membership? A free one! Setting up a home gym can be simple as setting aside a workout mat and a few weights. You can set up a fitness playlist with popular YouTubers like Blogilates and MadFit. Of course, many of these YouTubers already have built sets and free printable calendars to build a routine; just click and get started!

96. Let Your Employer Foot Your Education

Going back to college can be really expensive! If you’re looking to get a degree and aren’t finding many scholarships, consider finding a company that will pay for your college. Many will offer grants or tuition reimbursement to cover some or all of your educational costs.

97. Utilize Baby Registries

If you love freebies and discounts, signing up for one of the many baby registries online will get you a hookup! Major retailers like Amazon, Target, BuyBuy Baby, and Walmart offer free baby welcome kits filled with free baby stuff, samples, vouchers, and coupons if you sign up for their registry.

98. Forgo the Salon

While you may be loyal to your stylist, you may be able to spend less at the salon by visiting a cosmetology school. If you’re looking for cheap haircuts with more experienced stylists, there are also plenty of discount salons with regular deals.

Related: Where to Find Cheap Haircuts

99. Adopt From Breed-Specific Rescues

Pet rescues offer lovable mutts, but with patience, you can even find purebred dogs without having to go through a breeder. Sites like PetFinder.com can help you narrow your search down by gender, breed, and age. You can also reach out to a breed-specific rescue and get on the wait list.

100. Foster a Furry Friend

If you’re not sure you can shoulder the cost of a new forever family member, try fostering with a local rescue. Rescues often need in-home care for their dogs and cats for temporary stays. Plus, they’ll often cover all veterinary care, basic supplies, and food, so you can love a pet for less.

Download the KCL app to add and redeem coupons in store